Which of the Following Is a Type of Seller Financing

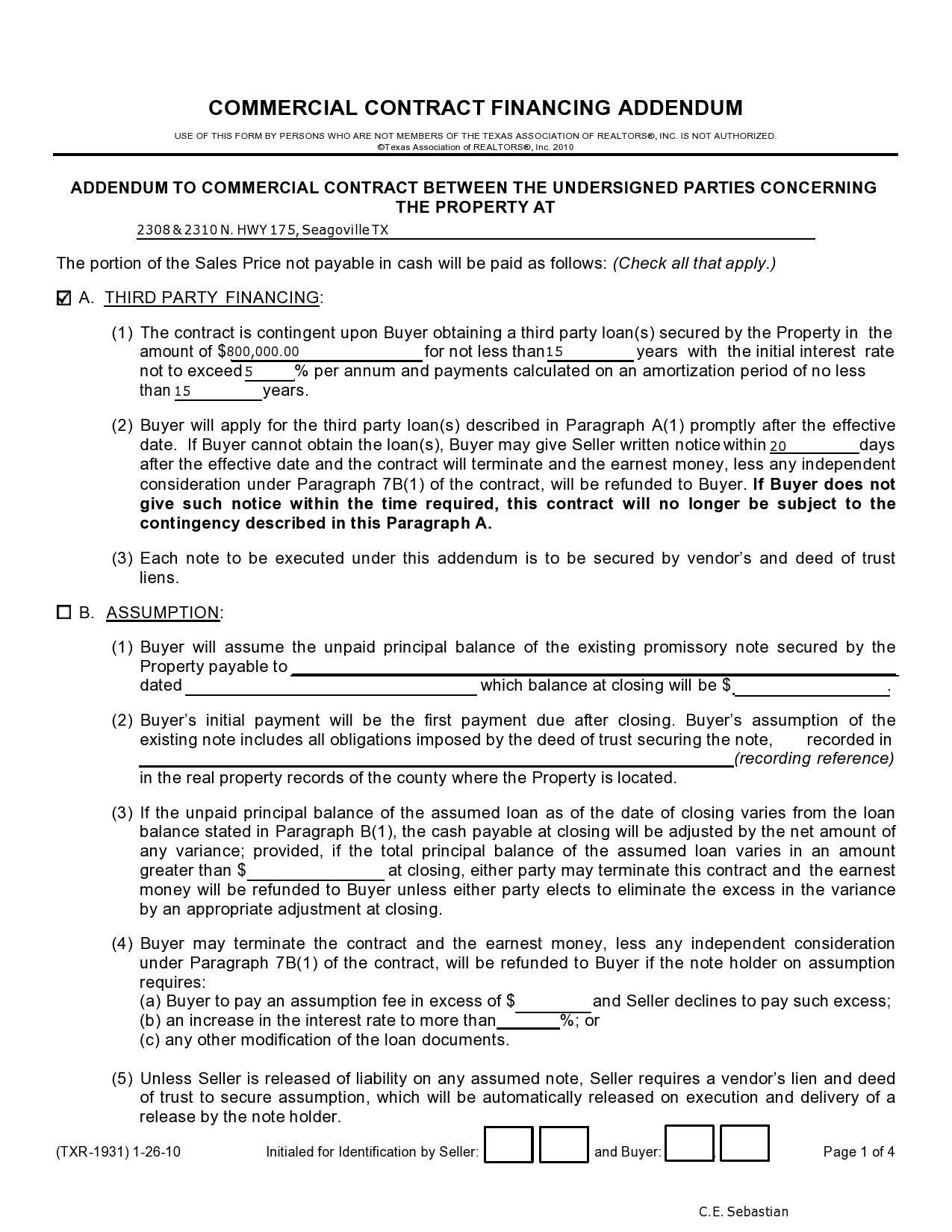

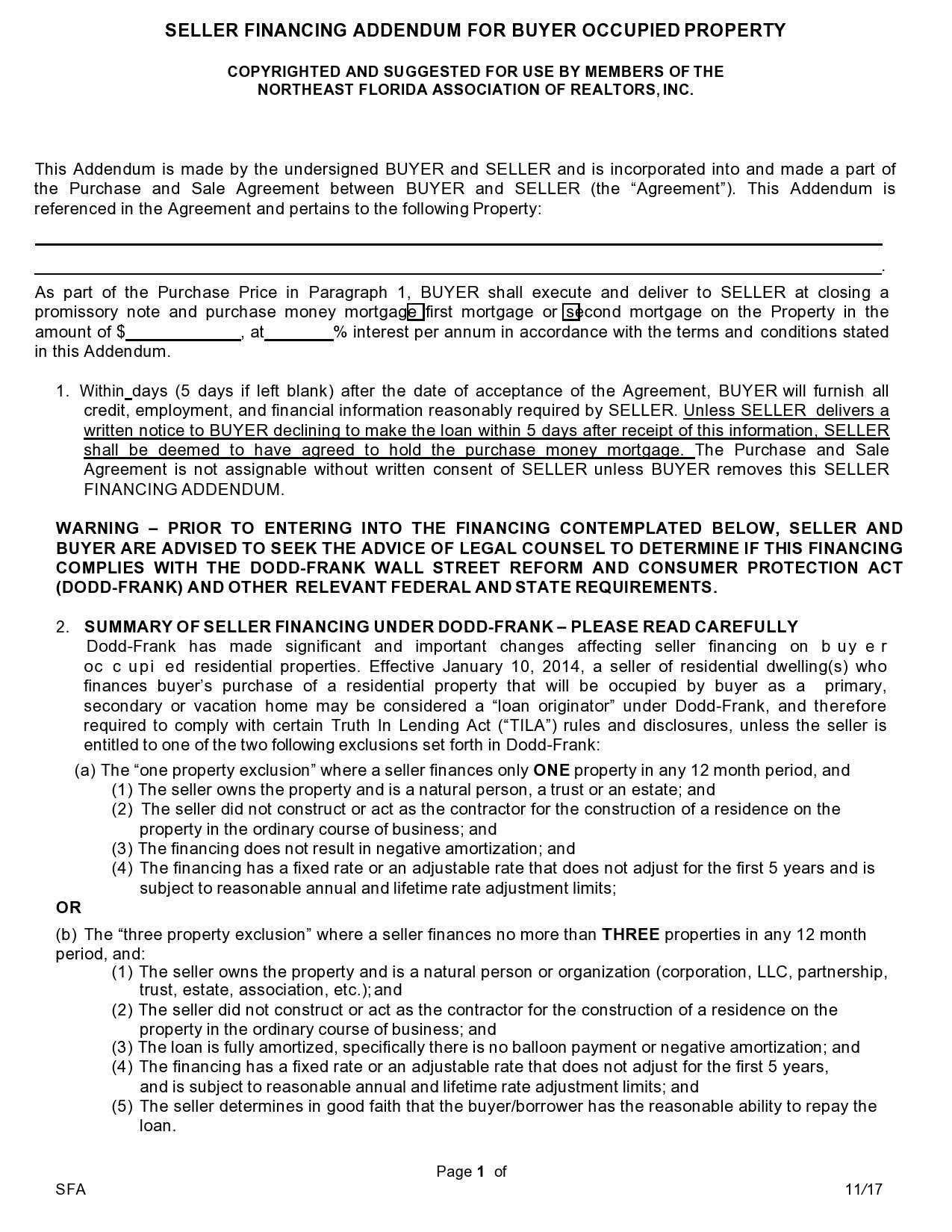

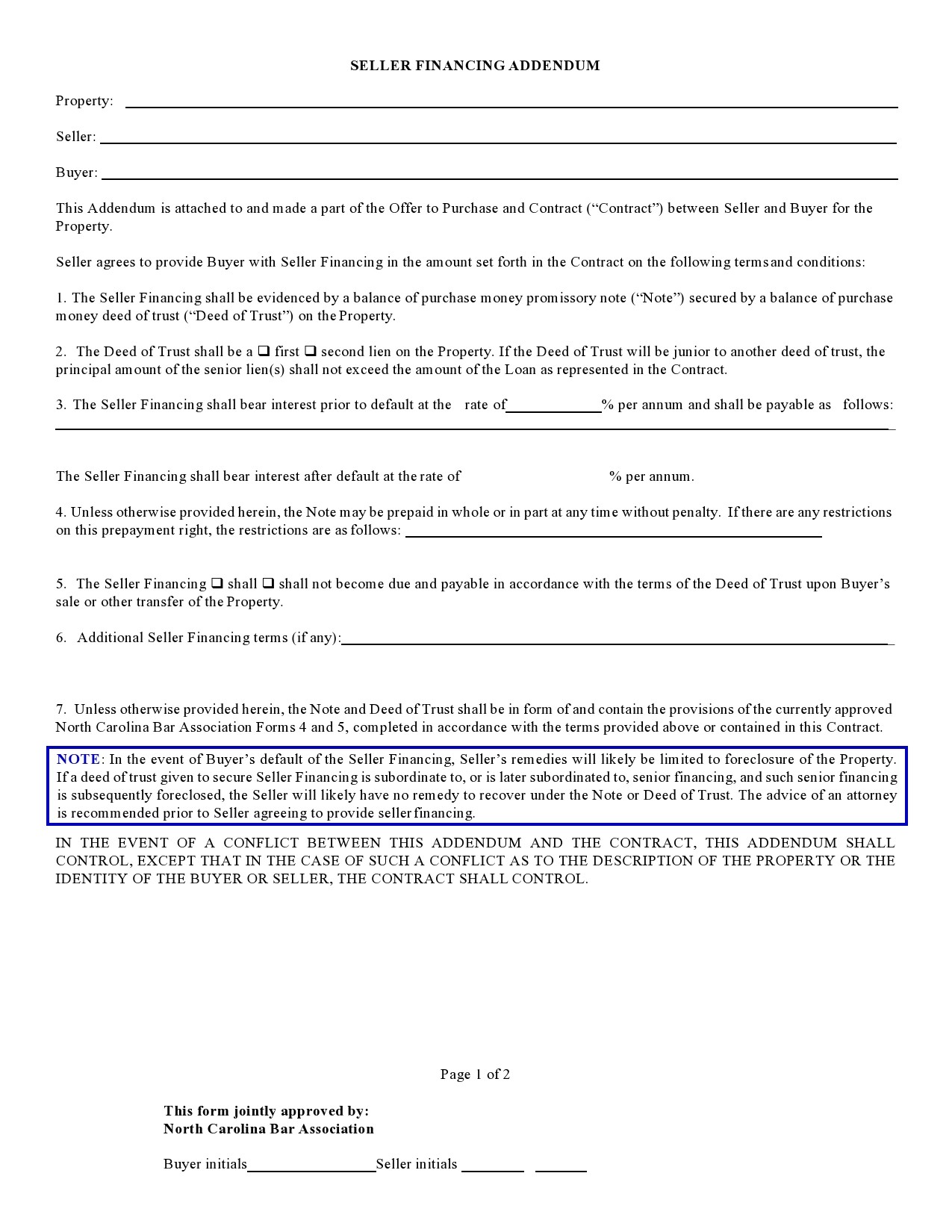

Typically there are three legal documents needed for seller financing. Conditional Sales Contract D.

/14037125672_68ca580a76_k-c6247edc6c784ac2acfbb02b6077d0f9.jpg)

Owner Financing Pros Cons For Homebuying

The installment contracts are the most common form of seller financing because its the easiest way to repossess a property if the borrower stops making payments.

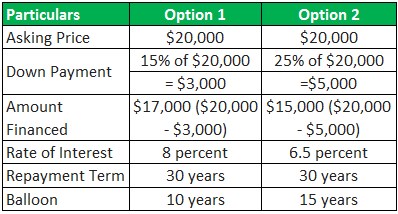

. Both A and B What is the advantage to the borrower in owner financing. Seller financing is a type of financing that allows the buyer to pay a principal amount directly to the seller. A transaction where the seller also acts as the lender to the buyer.

Most importantly the financing terms. As noted above seller financing means a seller wont be subject to a bank requiring certain repairs be made to the property before the loan can close. Nearly 1000 communities across the United States have created that designate a portion.

In which of the following types of owner financing does the seller retain title to the property until the full debt is paid. To help finance the deal Andrew was able to obtain seller financing for a term of 10 years at 65. Owner financing attracts a different set of buyers.

Sale of receivables Foreign currency translations Operating leases Special purpose entities Show Result Correct - Your answer is correct. Bond for Deed c. If a property is not selling under conventional methods offering owner financing is one way to stand out from the rest.

Agreement between buyer seller - buyer assumes liability seller not completely released - is SECONDARILY LIABLE - lender could sue seller. Seller financing deals have high risks for the seller and usually require higher. Andrew recently purchased a commercial investment property.

Promissory Note This document is the Buyers promise to pay for the property. Contract for Deed B. Owner financing is a safe way to finance the purchase of a home as long as the buyers and sellers take precautions to protect their financial interests.

Seller-financed sales thereby eliminate third-party lenders from the. The seller provides the financing. Owner financing can carry a higher rate of interest than a seller might receive in a money market account or other low-risk types of investments.

A purchase-money mortgage is a. All of the above. As used in this part Commercial interim payment means any payment that is not a commercial advance payment or a delivery paymentThese payments are contract financing payments for prompt payment purposes ie not subject to the interest penalty provisions of the Prompt Payment Act in accordance with subpart 329A commercial interim payment is given to the.

Deed of Trust This document gives the Seller a lien on the property. Both A and B d. If the buyer is a tenant who wants to buy the home the buyer gets the home theyre.

In seller financing options include carryback financing contract for deed and a wraparound mortgage WRAP or all-inclusive trust deed AITD. In which of the following types of owner financing does the seller retain title to the property until the full debt is paid. Seller financing is a method of financing that is used by buyers and sellers in real estate to overcome certain obstacles that might otherwise stand in the way of closing the deal.

Seller financing is just what it sounds like. Andrews use of seller financing is an example of what. RELEASE - from lender - agrees to accept buyer as new mortgagor release seller.

When used in the context of residential real estate it is also called bond-for-title or owner financing Usually the purchaser will make some sort of down payment to the seller and then make installment payments over a specified time at an agreed-upon interest rate until the loan is. A real estate agreement where financing provided by the seller is included in the purchase price. All of these are loans that an asset-based lender makes.

In which of the following types of owner financing does the seller retain title to the property until the full debt is paid. In which of the following types of owner financing does the seller retain title to the property until the full debt is paid. It is also known as a purchase-money mortgage.

Which of the following is not a type of loan that an asset-based lender makes. Purchase order financing B. 000 747.

In an all-inclusive mortgage or all-inclusive trust deed AITD the seller carries the promissory note and mortgage for the entire balance of the home price less any down payment. Purchase Money Mortgage d. Reliable way to sell to tenants.

Contract for Deed b. Seller financing in real estate is quite literally when the seller of a property finances the transaction. Installment Contract The seller receives a normal down payment and the borrower makes regular installment payments until the balance of the purchase price plus interest is paid in full.

Heres a quick look at some of the most common types of seller financing. Seller financing is a loan provided by the seller of a property or business to the purchaser. Installment Land Contract C.

Property can close as is. Line of credit financing O E. In this article I want to talk about what seller financing is how it works its types and the advantagesdisadvantages for buyers and.

Accounts receivable financing C. Both A and B. Seller financing avoids bank fees which makes the transaction cheaper for all parties.

The seller essentially acts as the bank and holds a note. In other words the owner of the property acts as the bank and although legal ownership is changed hands the payment is sent directly to the previous owner rather than a bank. Warranty Deed This document transfers the property to the Buyer.

The buyer furnishes a down payment and borrows the rest from the seller. True The primary difference between the purchase money mortgage and the contract for deed is that in the contract for deed the seller retains legal title to the property until part or all of the debt is paid. Which one of the following is not a form of off-balance-sheet financing.

What Is Seller Financing Quicken Loans

Owner Financing Definition Example How Does It Works

Seller Financing Overview How It Works Advantages

Free Rental Owner Finance Application Form Real Estate Forms Real Estate Templates Legal Forms

Owner Financing Definition Example How Does It Works

43 Seller Financing Addendum Samples Free ᐅ Templatelab

Free Owner Seller Financing Addendum Pdf Word

43 Seller Financing Addendum Samples Free ᐅ Templatelab

Seller Carryback Financing When The Seller Becomes The Bank

Owner Financing Definition Example How Does It Works

Seller Financing Addendum Trec

Owner Financing What It Is And How It Works Forbes Advisor

Owner Financing Contract Template Pdf Templates Jotform

43 Seller Financing Addendum Samples Free ᐅ Templatelab

43 Seller Financing Addendum Samples Free ᐅ Templatelab

Owner Financing Contract Pdf Template Ready For Editing And Printing

Comments

Post a Comment